BYSANTTI

Another Appreciation

Helsinki, FI

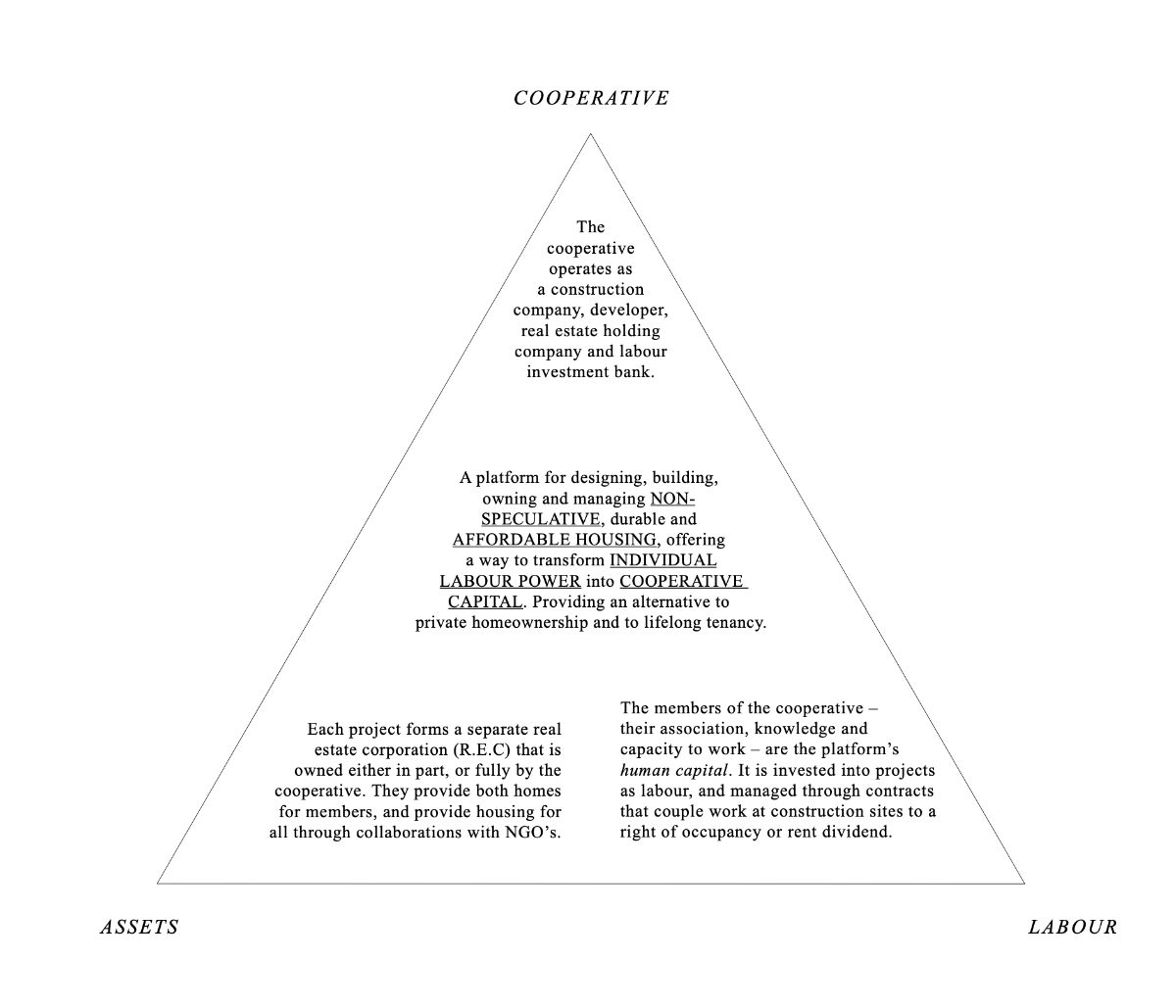

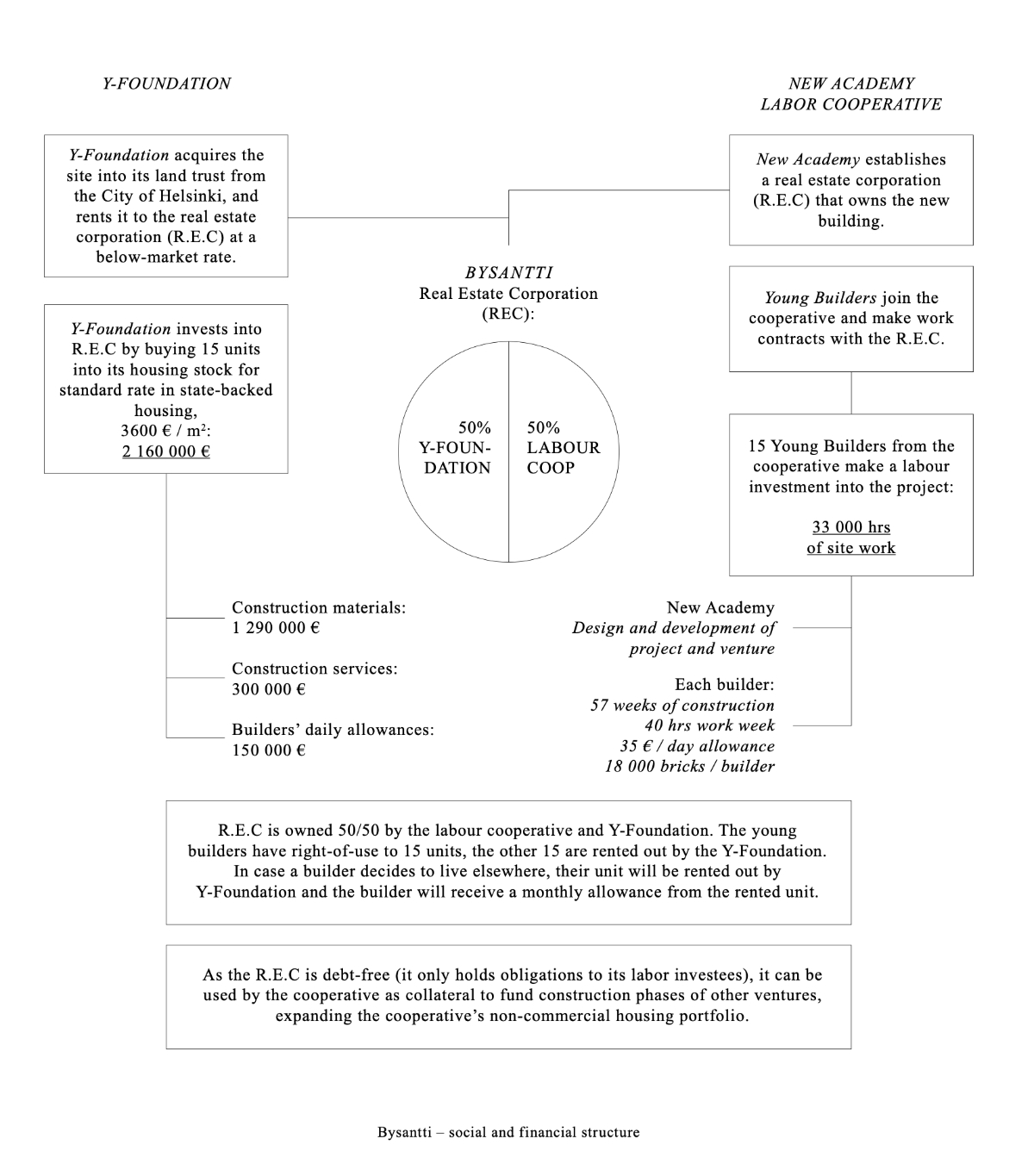

This project was developed in collaboration with Y-Foundation (Y-Säätiö) Finland. Y-Foundation is a non-profit NGO combatting homelessness in Finland. Unlike the ‘treatment before housing’ approach that has been prevalent for the past three decades, Y-Foundation operates on a housing first principle that prioritizes housing as a basic human right. For the homeless with mental health and substance issues, this places access to housing as the foundation for addressing their social and health issues. Y-Foundation currently owns and manages over 16,000 housing units and engages in the development of affordable housing through the framework of ARA, the Housing Finance and Development Centre of Finland.

During their years of operation, Y-foundation has observed a worrying correlation of rising rental prices with increases in government housing subsidies. Though ostensibly socially progressive, housing subsidies have also served to create a very profitable environment for private landlords and developers as subsidies increase the price floor that prospective tenants can afford. Finland provides over two billion euros of housing subsidies annually, of which over 50% go to rents on the private landlords. Y-Foundation has stressed the need for additional affordable social housing and though they are committed to building an additional 350 affordable housing units in 2019, it can only operate with the limited means at its disposal.

A growing problem in Finland is the increasing number of youth that are unable to continue into either vocational training or higher education. With poor job prospects and limited access to credit, these youths are at high risk of marginalization and homelessness as they grow older. With the rising trend of homelessness caused by debt and insolvency, this project, Bysantti, is established as a cooperative venture with at risk youth, providing them with housing in return for their building labour. The youths develop skills in construction and building maintenance, while also providing them with a stable living environment that can support them in the future.

The project is situated on a challenging site that has been avoided by conventional development due to costs needed for foundations and ground work. By situating the project on top of a series of vertical structures constructed by hand from brick, the project avoids costly foundation work through laborious construction that navigates the difficult topography of the site. The sloping site also allows for handicap accessibility without the need for elevators, reducing long term costs. By prioritizing labour over capital costs, the project allows for a building made up of a monolithic brick structure, one that is extremely durable while only costing 1300 euros per square meter in materials.

Planned for a construction period of two years, Bysantti consists of 1200m2 of affordable housing along with a communal ‘shed’ that begins the construction process. The shed is built as a ‘prototype’ building, allowing the construction team to familiarize themselves with the building process by going through all the phases of construction. The shed then becomes a workshop for the construction process, and is a communal space for meals and relaxation. The process of building is itself a collective endeavour, where the workers will build, eat, and live together.

Operating under the ARA developer price target of 3600 euros per square meter, Y-Foundation provides the startup capital equivalent to 15 of the 30 units that will be managed and rented out through their M2Kodit program for affordable housing. Y-Foundation retains ownership of the land as part of its land trust, preventing any future speculation of the site. The remaining 15 units are owned by the labour cooperative, and distributed to the workers in exchange for their building labour. In addition to providing a stable living environment for the workers involved in the project, the units will serve as collateral for future developments, allowing the cooperative to expand its operations.

*This project was initated as a part of Promised Land: The Ownership, Construction and Typology of Affordable Housing, a collaboration between Dogma and New Academy. It was presented at the 2019 Seoul Biennale and supported by the Finnish Cultural Foundation. The research focuses on collective habitation not as an idealist projection, but as a structural re-consideration of the entire housing production process: from land procurement to home ownership, from construction to typology.